News Article

QIMA 2024 Q4 Barometer

Global Supply Chains Battle Old and New Disruptions, Poised for the Coming US Election Fallout

Nine months into 2024, the global sourcing landscape is in a tug-of-war between rebounding demand and numerous challenges on the supply side. Armed conflicts and natural disasters are disrupting trade and manufacturing, as is industrial action: most recently, the large-scale dockworker strike on the US East Coast. Buyers are responding by extending lead times, shortening supply chains and, in some cases, revisiting partnerships with China. However, that particular strategy may pose risks for American brands, depending on the outcome of the US presidential election.

This barometer report, informed by QIMA’s data on product inspections and factory audits in all major sourcing regions, offers a snapshot of the state of global procurement as 2024 draws to a close.

As new and old disruptions rock global sourcing, Western buyers turn to China to save Christmas

As disruptions become the norm in global sourcing, brands and retailers have begun preparing for the 2024 holiday season early, with many looking to China to be their port in the storm. QIMA data reveals a 21% year-over-year increase in demand for inspections and audits in China from US and EU buyers in Q3 2024. Electronics and Electricals (+41% YoY) and Homewares (+22%) were among the most in-demand product categories. Textiles and Apparel inspections also saw a +23% rise, likely due to the reduced availability of Asia’s other textile hubs this quarter.

Appetite for Chinese manufacturing from emerging economies remains strong. Trade with Latin and South America is particularly active, with inspection and audit demand from Mexican businesses still booming (+78% YoY in Q3 2024).

This quarter’s trends, following on China’s successful H1, confirm that the manufacturing giant remains a crucial sourcing partner globally, despite US supply chains gradually decoupling from the country. However, newly imposed tariffs and an upcoming crackdown on untaxed e-commerce purchases are creating tension and uncertainty for US businesses relying on China. With the presidential election approaching, the next few months could be crucial for trade relations between the two economic powers.

Breakthrough in labor talks signals hope for Bangladesh’s troubled garment sector

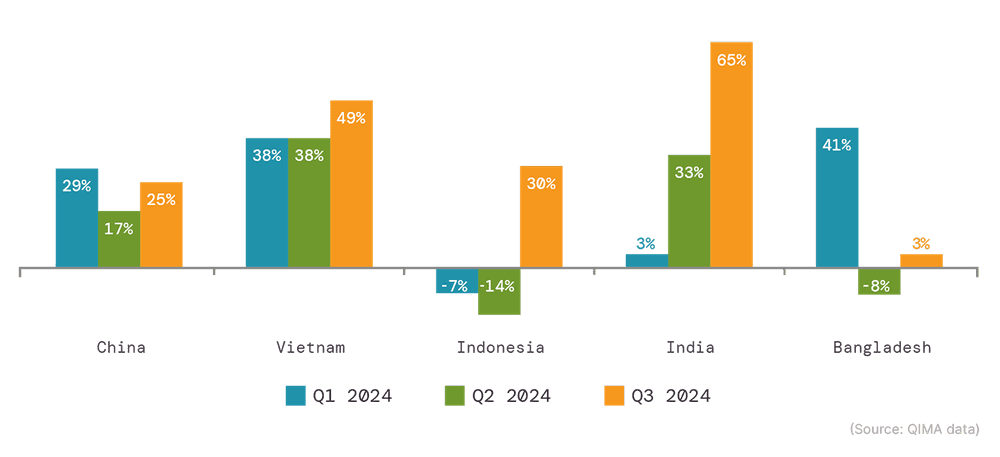

Between political upheaval and industrial action, Bangladesh’s textile and apparel sector has struggled throughout 2024. With dozens of factories shutting down due to labor unrest, global brands and retailers have had to turn elsewhere to stock up for the holiday season. QIMA data shows that demand for textile and apparel inspections in Bangladesh in Q3 ’24 only grew +3% YoY, at the same time as demand for the same services in China, India, Indonesia and Vietnam has spiked.

However, in late September, the media reported that, after long negotiations, the ready-made garment (RMG) industry representatives and worker unions had reached an agreement. With plans in place to increase compensation and worker protections, garment factories are reopening, promising much-needed relief to Bangladesh’s economy, in which apparel exports account for around 85% of total export by value.

Fig. B1. Textile and apparel inspection and audit demand in selected countries (from buyers globally), YoY growth in Q1 through Q3 2024

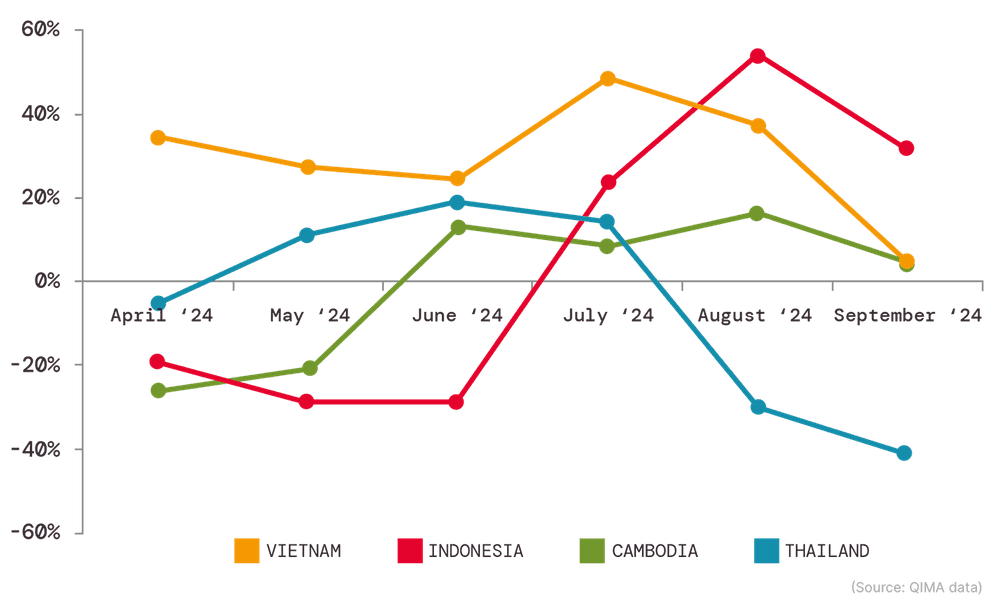

Extreme weather and demand fluctuations dampen Southeast Asia’s peak manufacturing season

With holiday preparations in full swing, Southeast Asia’s manufacturing hubs had an overall successful third quarter: QIMA data shows demand for inspections and audits expanding by double digits year-over-year in Vietnam, Indonesia and Cambodia. September, however, saw demand for Southeast Asia sourcing take a dip, potentially linked to a combination of demand fluctuations and lost business in factories impacted by Typhoon Yagi.

The typhoon, estimated to be the strongest storm of 2024, has caused US $1.6 billion in economic damages in Vietnam, including damage to factories that will require several weeks to repair. It is the latest example of the growing impact of extreme weather events on the global sourcing landscape, following the logistics chaos caused by monsoon flooding in South Asia and the disruption of shipping lanes during the hurricane season in the Atlantic.

Fig. V1. Inspection and audit demand in selected countries (from buyers globally), YoY growth in April – September 2024

Tightening regulations on PFAS drive a surge in product testing

While navigating the turbulent state of global trade, buyers also face increasingly stricter standards for product safety and quality, as consumer safety regulations are tightening worldwide. Recent developments in PFAS compliance are a vivid example.

PFAS, also known as “forever chemicals”, have been among the priority targets of product safety regulators in the past year. Now, consolidated data from QIMA’s labs shows that demand for tests to determine PFAS content in finished products has almost doubled year-over-year in the past 12 months, suggesting that brands and retailers are putting in the effort to keep their chemical compliance programs in line with the evolving regulations.

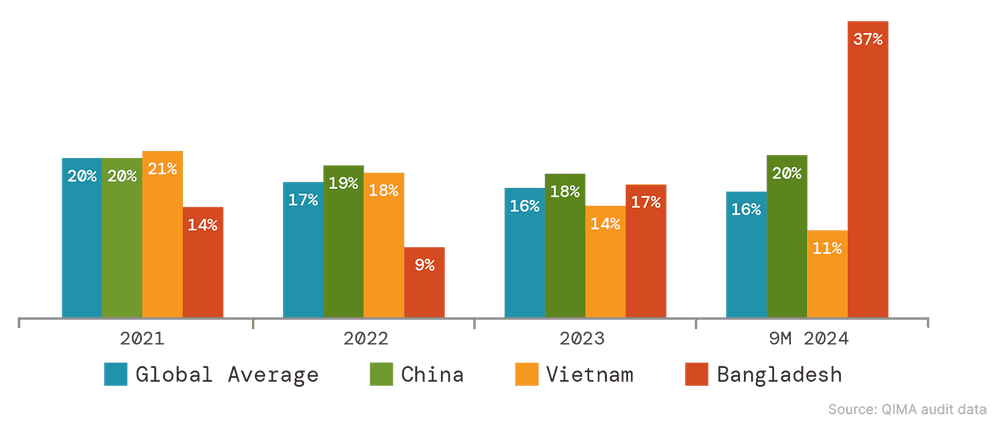

Stark data on factory violations underscores the unfortunate situation of Bangladesh garment workers

More than a decade after the Rana Plaza tragedy, Bangladesh is no longer synonymous with deadly working conditions. However, a year-long surge in protests by garment workers has highlighted ongoing issues with working hours, pay, and freedom of association in the Bangladeshi RMG sector.

Aggregated audit data from QIMA’s on-site investigations underscores the scope and escalation of these issues. From January to September 2024, critical violations related to working hours and wages were found in 37% of audited factories in Bangladesh, at more than double the rate of 2023. Consequently, average compliance scores in this category dropped by 26% from the previous year.

Additionally, over half of all critical non-compliances in Bangladeshi factories during this period were related to working hours and wages, compared to about one-third globally.

Compliance with working hours and wages has long been a pressing issue in global supply chains (as reported in QIMA’s previous barometers). The latest audit findings echo trade union concerns, suggesting that worker compensation issues in Bangladesh are endemic and pervasive. Despite these challenges, a recent agreement reached between the industry players and worker representatives in late September offers a glimmer of hope for improvement in the country’s garment industry.

Fig. E1. Incidence of critical violations related to working hours and wages identified during factory audits