News Article

QIMA 2024 Q2 Barometer

Q2 2024 BAROMETER: Q1 Procurement Uptick: a Beacon of Hope for Western Retail?

After a year of sluggish demand, the first quarter of 2024 witnessed a rise in sourcing volumes across the board, both in overseas supplier regions as well as nearshoring markets. This swell in procurement can be linked to multiple factors, such as fading recession fears and improved consumer sentiment in the West, inventory replenishment following the holiday season, as well as brands relying on larger shipments to mitigate longer freight transit times on routes affected by the Red Sea crisis.

This barometer report, informed by QIMA’s data on product inspections and factory audits, as well as our recent survey of 800+ businesses, offers an early glimpse into the state of the sourcing landscape in 2024 and expectations for the upcoming months.

China Sourcing Starts 2024 with a Bang

While in 2023, QIMA data showed that much of China’s growth was driven by emerging regions’ demand, Q1 ’24 saw the appetite for made-in-China bouncing back in the West. Demand for China inspections and audits among US-based buyers grew by +12% YoY, while among European brands, the growth was even faster: especially from buyers based in Germany (+35% YoY), France (+30% YoY), and the Netherlands (+33% YoY). Meanwhile, interest in China’s manufacturing capacities remained robust among buyers in other parts of Asia, as well as in Latin and South America, with double-digit growth in inspection and audit demand across the board.

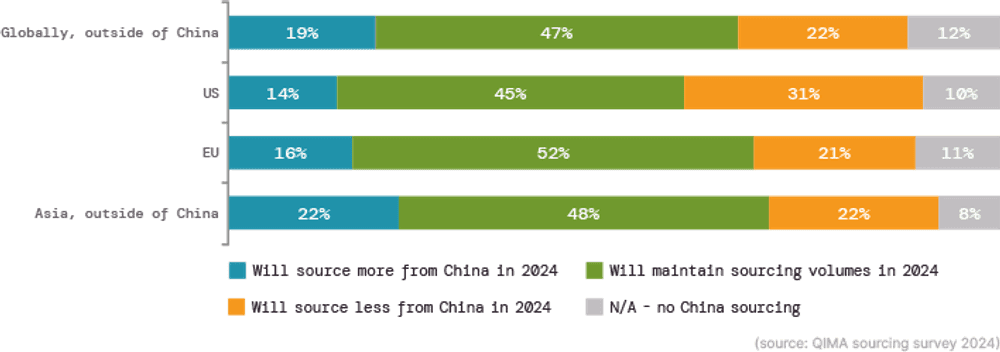

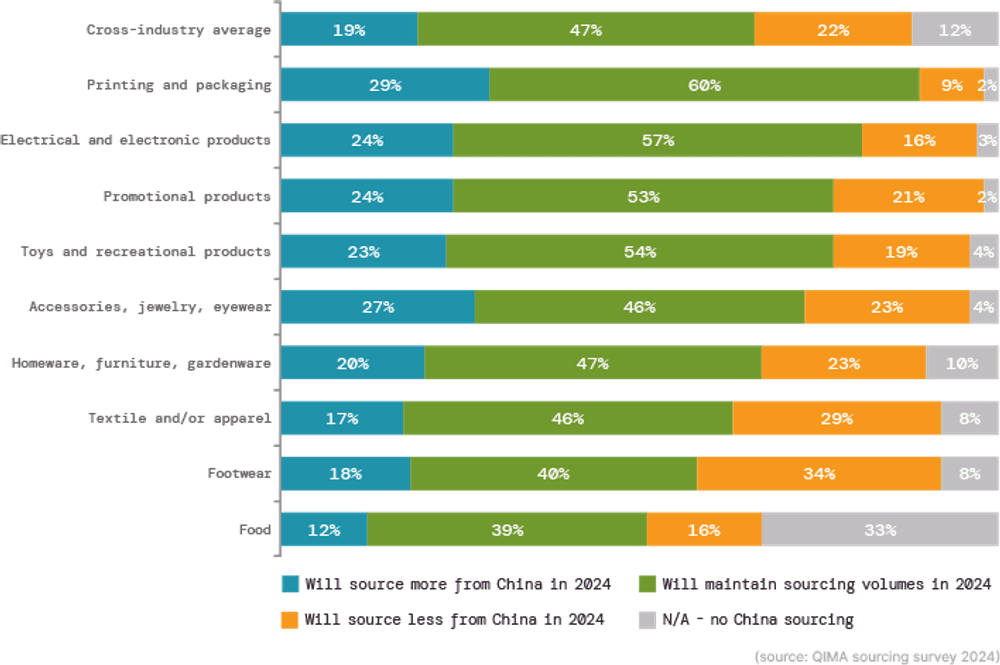

These trends align with the buyer sentiments observed in QIMA’s latest survey, where two-thirds of respondents globally plans to maintain or increase business volumes with Chinese suppliers in 2024. In the US, 59% of buyers, and in the EU, 68% of buyers, expressed similar intentions. Looking at specific industry, sectors with the strongest interest in China sourcing included Electronics and Electricals, and Promotional Products.

Fig. C1: China sourcing plans for 2024, as reported by businesses (by buyer region)

Fig.C2: China sourcing plans for 2024 (by industry; businesses located outside of China)

Textile Sourcing Picks Up Globally as Brands Restock After the Holidays

Fashion brands are taking the opportunity to restock after the year-end consumer splurge on apparel and accessories, QIMA data suggests. Following a slow 2023, demand for textile and apparel inspections and audits was up +20% YoY in Q1 2024 globally. And while China is experiencing a resurgence in popularity among apparel brands, its competitors in Asia and beyond are keeping pace.

Both US-and EU-based brands stepped up their procurement in Bangladesh, instilling optimism that the country’s export sector will perform better this year compared to 2023, when a political crisis halted a significant portion of Bangladesh’s manufacturing. Whether that optimism will pan out remains to be seen, as the industry has some concerns about the Bangladeshi government’s recent policy move to reduce cash incentives for garment exports.

By contrast, India, another established textile powerhouse, saw much slower growth in demand for textile and apparel inspections and audits (+7% YoY from Western buyers), a possibly due to ongoing diversification of its exports into new sectors such as electronics.

Nearshoring sourcing regions also proved important for the EU’s textile sourcing this past quarter, with QIMA data recording double-digit expansion in inspection and audit demand in Turkey, Morocco, Egypt and Jordan.

EU Nearshoring Going Strong Despite Geopolitical Risks

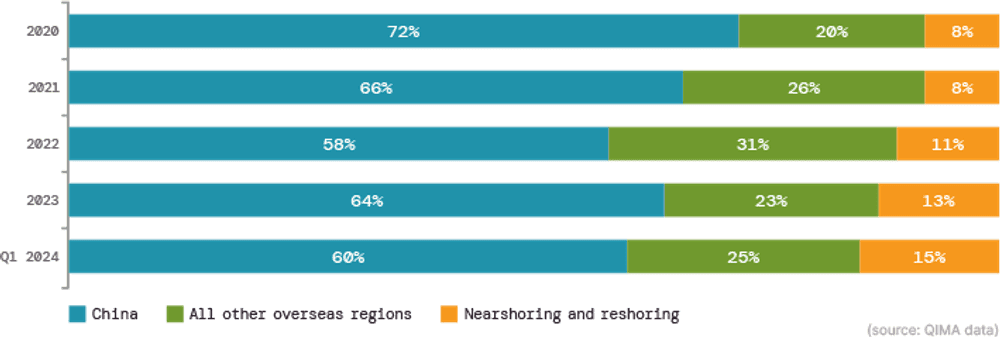

After winning market share from a number of overseas sourcing destinations in 2023, nearshoring is poised to stay popular this year among Western buyers on both sides of the Atlantic, QIMA data suggests.

In Q1 2024, the relative share of nearshoring in the sourcing portfolios of EU-based buyers continued its steady growth observed by QIMA in the past five years, with home and neighboring supplier markets now accounting for 15% of all purchasing by European brands and retailers. This includes continental Europe (where suppliers in France, Germany and Bulgaria experienced strong demand from within the EU), as well as the EU’s traditional sourcing regions around the Mediterranean (including Jordan and Egypt). The latter suggests that European businesses’ supplier partnerships in the region are staying resilient in the face of the current geopolitical risks in the Red Sea region.

On the other hand, US-based brands, despite expressing a strong interest in local sourcing (as seen in QIMA’s latest survey), appear to be slow in turning their nearshoring plans into reality. QIMA data shows relatively tepid year-on-year growth in Q1 demand for inspections and audits in Latin and South America, with Mexico still leading the way as the top sourcing destination for North American buyers.

Fig. N1: Relative share of overseas and nearshoring sourcing regions (EU-based buyers)

Fig. N2: Evolution of buyer interest in nearshoring and reshoring, 2023-2024 (by respondent HQ location)

Is the Current Sourcing Surge Bad News for Ethical Compliance?

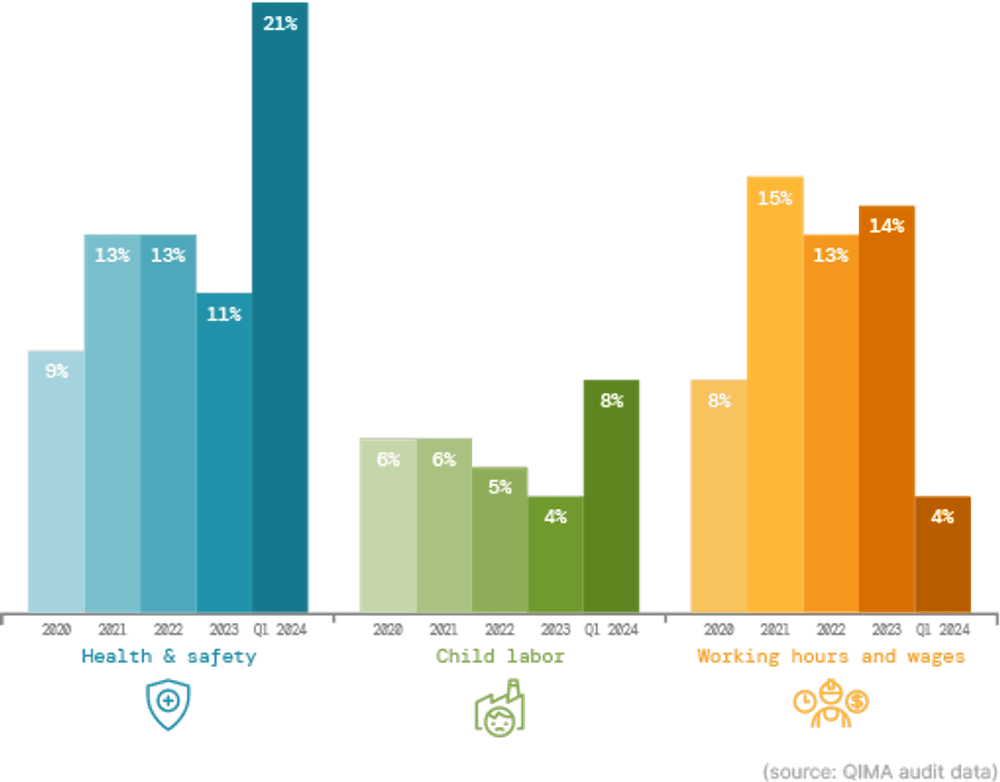

As buyers are increasing their shipment sizes to restock inventories, factories in sourcing regions may be cutting corners on worker safety and labor rights as they rush to meet the demand.

In Southeast Asia, the findings of QIMA’s ethical audits show a significant rise in the frequency of Health & Safety violations, as well as a higher incidence of Child Labor. In Q1 2024, 21% and 8% of audits respectively discovered critical violations in these categories in factories audited in Southeast Asia – representing a nearly twofold increase compared to the 2023 average.

In the meantime, ethical audits in South Asia have found a consistently high incidence of compliance violations related to Working Hours and Wages, suggesting that factories may be relying on unpaid or forced overtime to cope with the surge in order volumes.

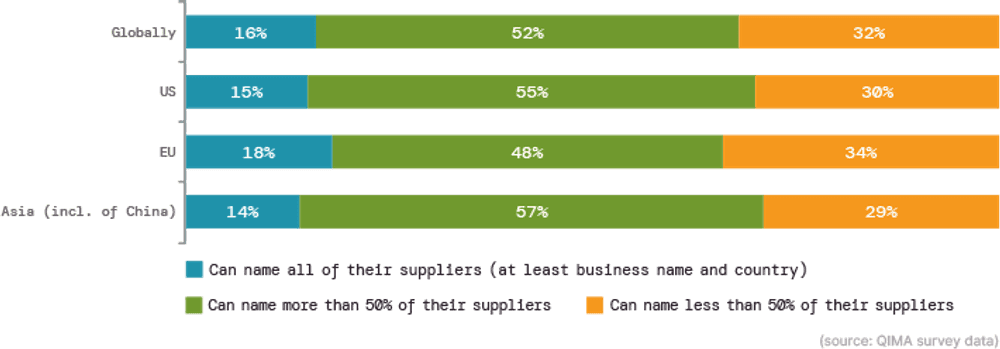

These trends are especially concerning when combined with the fact that supply chain visibility remains low across the board: QIMA’s recent survey found that only 16% of businesses globally were able to name all of the suppliers involved in the making of their products (while almost one-third knew less than half of their sourcing network).

Fig.E1: Percentage of audits discovering critical violations in given categories – Southeast Asia

Fig. E2: Supply chain visibility reported by businesses – by HQ location

Press Contact Email: press@qima.com