News Article

QIMA 2022 Q1 Barometer

Q1 2022 BAROMETER: Review of Global Sourcing for 2021: Is there an end in sight?

A tumultuous 2021 saw promising recovery trends falter with the resurgence of COVID-19 outbreaks, China's power crunch and ongoing logistics chaos. While many headlines described the supply chains' issues as a "nightmare before Christmas", QIMA's 2021 data suggests that the disruption is poised to linger long past the holiday season.

China: A Stifled Recovery with Hope for Resilience in 2022

Exemplifying a pattern seen in many of Asia's sourcing markets in 2021, China sourcing mounted an impressive rebound in the first half of the year, only to stutter in Q3 onwards. Nevertheless, the manufacturing giant is proving more resilient compared to its regional competition, with inspection and audit demand in 2021 growing +21.5% YoY and +13% respectively compared to 2019.

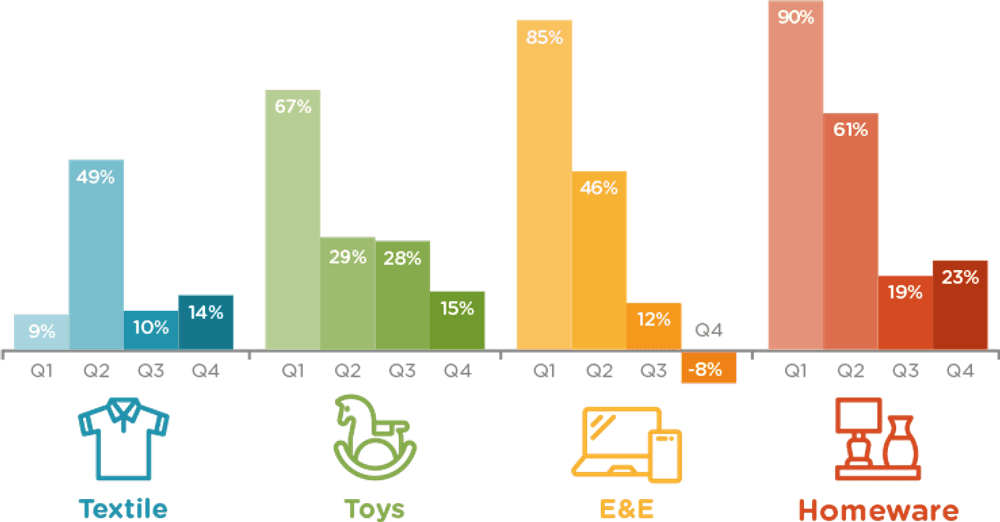

After a promising first half of the year, the second half of 2021 proved lackluster for China manufacturing, with the September power crunch throwing a wrench into preparations for the holiday goods peak season. However, demand for inspection and audits in China rebounded relatively quickly in most major consumer goods categories, including Textile and Apparel, Toys, and Homeware. A notable exception was the Electronics and Electricals industry, which has seen inspection and audit demand shrink steadily since May 2021 as more and more electronic producers felt the brunt of the global semiconductor chip shortage.

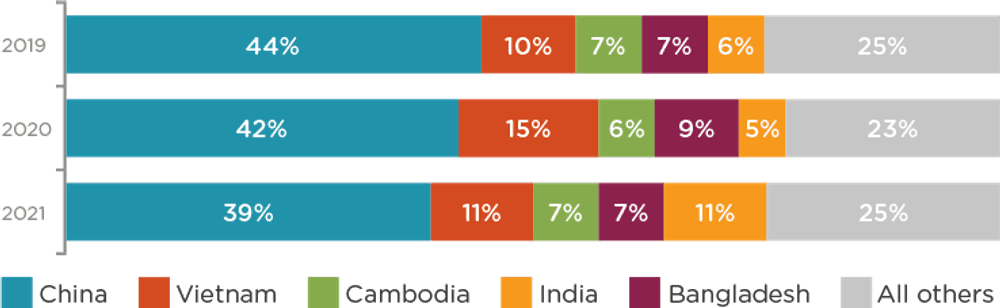

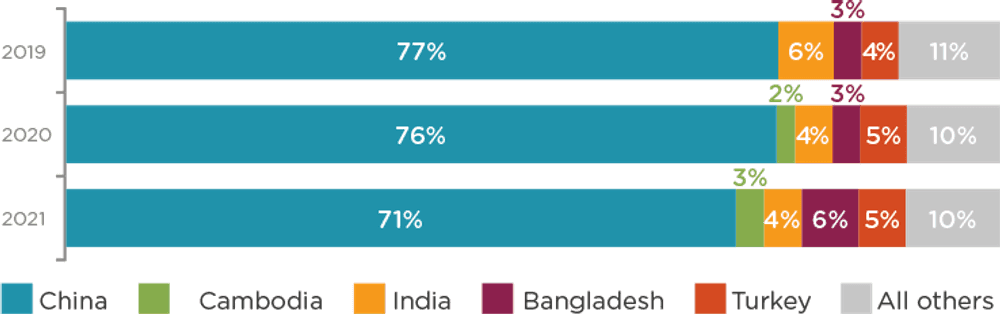

QIMA data on inspections and audits suggests that Western buyers remained cautious on China throughout 2021. Short of returning to China en masse, it appears many buyers simply maintained their existing business with Chinese manufacturers, demonstrated by the fact that China's share among the top 5 sourcing regions of both US- and EU-based buyers in 2021 remained at a three-year low.

The overall trend of China sourcing in 2021 paints a picture of a post pandemic recovery that, while not being derailed entirely, has definitely hit a few bumps in the road. In addition, power curbs may remain a threat in the months to come, as might potential manufacturing restrictions in northern China due to the upcoming Winter Olympics in Beijing. As a result, while there is room for optimism for China sourcing in 2022, such optimism should be cautious.

Fig. 1. China YoY inspection and audit growth dynamic during 2021 (selected industries)

Fig. 2. Top 5 shares in all sourcing (US buyers)

Fig. 3. Top 5 shares in all sourcing (EU buyers)

Vietnam: The Rise and Fall of a COVID Recovery Success Story

The boom-and-bust story of Vietnam sourcing in 2021 highlights the ongoing volatility of the global sourcing landscape, serving as a case study on the compounding effects of pandemic-related disruptions.

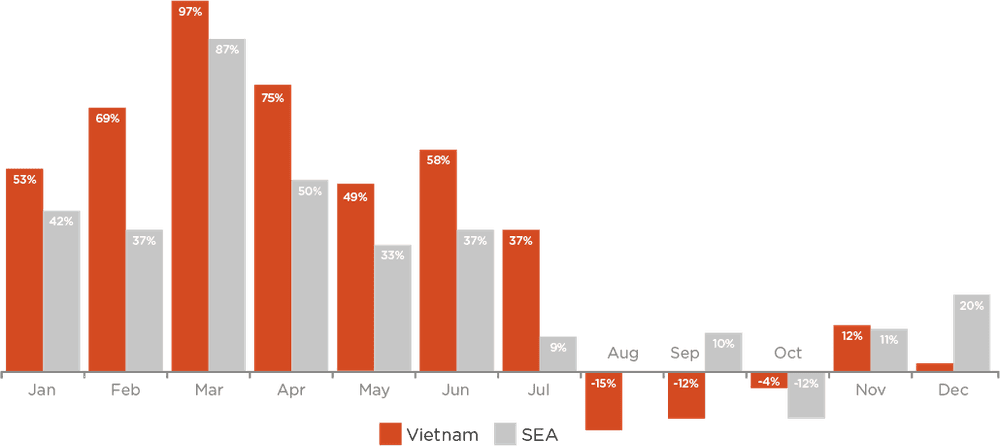

In the first half of 2021, Vietnam saw a vigorous growth spurt, powered by the enthusiastic attention of Western buyers flocking to a familiar sourcing market with successful virus containment. In January through July 2021, QIMA recorded high double-digit growth in inspection and audit demand volumes compared to pre-pandemic 2019, with a robust +67% expansion in H1 2021 vs. H1 2019.

However, the arrival of the COVID-19 Delta variant in late July prompted a lockdown that slammed the brakes on Vietnam's recovery, resulting in three consecutive months of shrinking inspection and audit demand. Now, almost a full quarter since the virus containment measures were lifted in October, the latest data shows Vietnam's manufacturing is still struggling to rebound. Acute labor shortages are a major factor in this: as soon as the lockdown was lifted, factory staff left the cities in droves, resulting in shortages of over 100,000 workers in the south of Vietnam. As of late November, over a third of factories in Vietnam were reported to be operating below 80% capacity, with orders delayed by more than eight weeks.

Vietnam's footwear and apparel sector was among the hardest hit by the lockdowns and subsequent labor shortages, with Q4 inspection and audit demand plummeting -29% YoY.

As a result of this dramatic reversal of fortune, Vietnam inspections and audits grew by a paltry 3% in H2 2021 compared to the prepandemic period. Vietnam's recovery is expected to be gradual, lasting well into 2022.

Fig. 4. Vietnam and Southeast Asia inspection and audit growth, 2021 vs 2019

EU's Near-Shoring Regions Benefit as Buyers Seek to Shorten Supply Chains

Inspection and audit demand from EU brands in the Mediterranean and Middle East remained above pre-pandemic levels during most of 2021, with Tunisia, Egypt and Jordan enjoying an influx of new orders. Turkey, whose manufacturing rebound after 2020 virus containment measures has been largely successful, saw inspection and audit demand expand by +11.5% in 2021 compared to 2019 (+32% YoY).

Meanwhile, the Mediterranean and Middle East region as a whole showed an impressive +81% expansion in audit and inspection demand from EU buyers compared to 2019 (+40% YoY) as more brands moved their manufacturing closer to home, shortening their supply chains in order to sidestep the steeply rising shipping costs and, hopefully, minimize disruptions.

Recovery in Latin and South America Dampened by Supply-Side Bottlenecks and Logistics Chaos

Post-pandemic recovery in the near-shoring regions for US buyers has been more disparate, as South and Latin American manufacturers continue struggling with the compounding challenges of the pandemic and global supply chain chaos. Inspection and audit demand from US-based buyers in Mexico has contracted compared to 2019 for five consecutive months, with raw material shortages and logistics issues causing severe delays and pushing up manufacturing costs.

India: 2021 Takeaway - Sourcing Diversification Efforts

Hailed by experts as an increasingly attractive sourcing market for many product categories, India has moved to the forefront as many US-based buyers' preferred alternative to China and its neighbors in 2021.

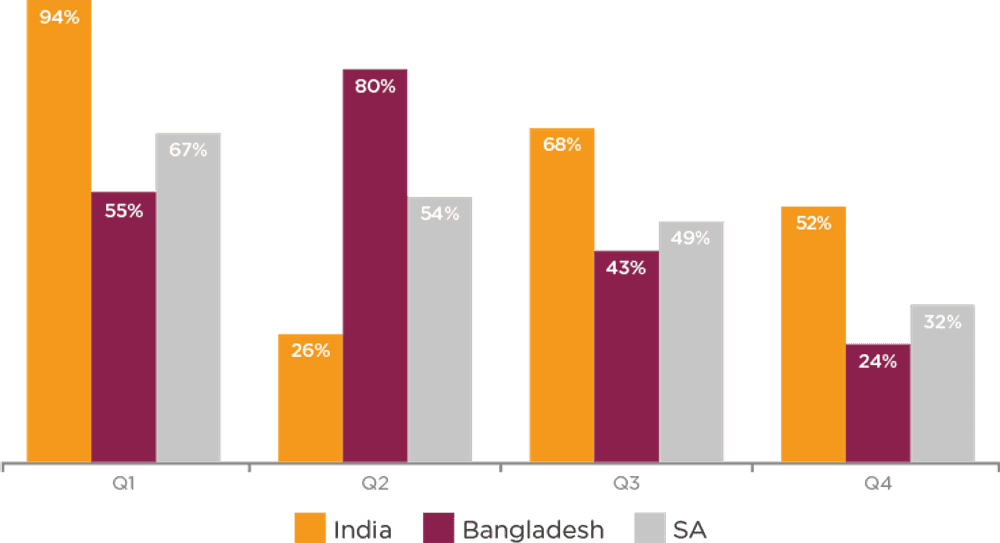

While the entire South Asia region showed double-digit expansion in inspection and audit demand throughout 2021 compared to the prepandemic period, India emerged a definitive favorite, outperforming its neighbors and the region as a whole in all but one quarter of 2021. A large part of India's success can be attributed to surging interest among US-based brands: the share of India among their top 5 sourcing regions has almost doubled in 2021 compared to 2019.

Wrapping up the year with an impressive +60% spike in inspection and audit demand compared to pre-pandemic 2019 (+129% among US-based buyers), India proved an invaluable sourcing location for many buyers during 2021. What remains to be seen is whether India, now faced with the new threat of the Omicron COVID-19 variant, can maintain its winning streak in 2022.

Fig. 5. South Asia inspection and audit growth, 2021 vs. 2019

Long-Term Supply Chain Disruptions Prove Disastrous to Human Rights and Worker Safety

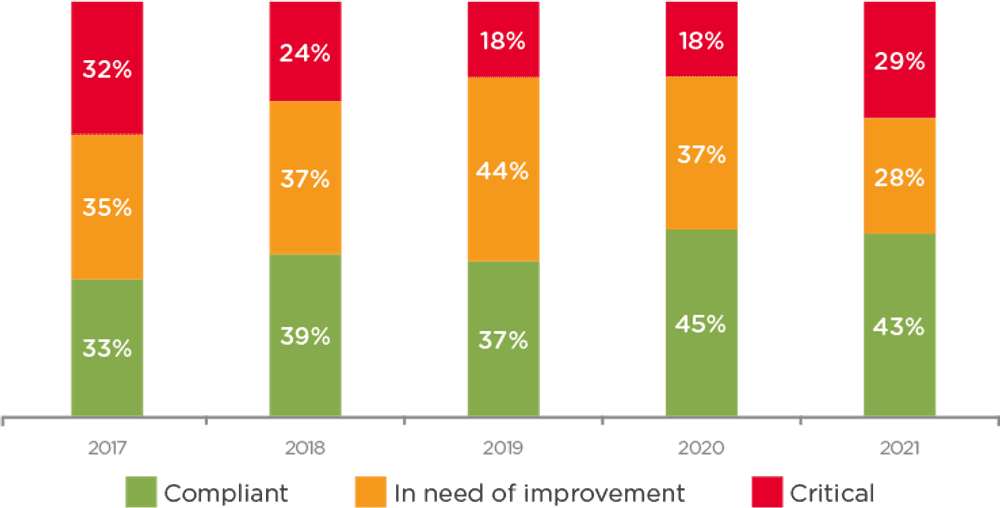

2021 saw ethical compliance in global supply chains deteriorate at an alarming pace, with QIMA audit data recording average factory scores at a four-year low. Almost a third (29%) of factories audited in 2021 were ranked as being critically non-compliant and requiring immediate intervention, the highest share since 2017. Consistent with the challenges of the pandemic, violations were particularly rampant in areas related to Health and Safety (where average 2021 scores dropped -7.5% compared to 2020) and Working Hours and Wages (scores down -8% vs. 2020).

Most recently, a supply chain report has pointed out a sharp increase in modern slavery and human rights risks in sourcing regions, with Southeast Asia seeing the largest rise in violations. QIMA audit data shows deteriorating ethical scores in the region, with Myanmar among the worst offenders (2021 ethical scores down -18% vs. 2020 averages).

This trend, although disheartening, is unsurprising, as past years have shown multiple examples of human rights and ethical compliance falling by the wayside as businesses are forced to operate in survival mode and prioritize cost concerns.

Fig. 6. Evolution of factory ethical rankings, 2017-2021

2022 Outlook: Strengthening Supply Chain Agility and Resilience

Despite the many hopes pinned on 2021, it did not turn out to be a year of recovery and return to a pre-pandemic normal. Amid new COVID-19 variants, disproportionate vaccination in different sourcing regions and varying approaches to virus containment, the impact of the pandemic on global supply chains remains significant. Coupled with raw material shortages, logistics hurdles and rapidly escalating ethical risks, the global sourcing landscape is expected to remain volatile in 2022 – and navigating it successfully will require a whole new degree of supply chain agility and resilience.

Press Contact

Email: press@qima.com